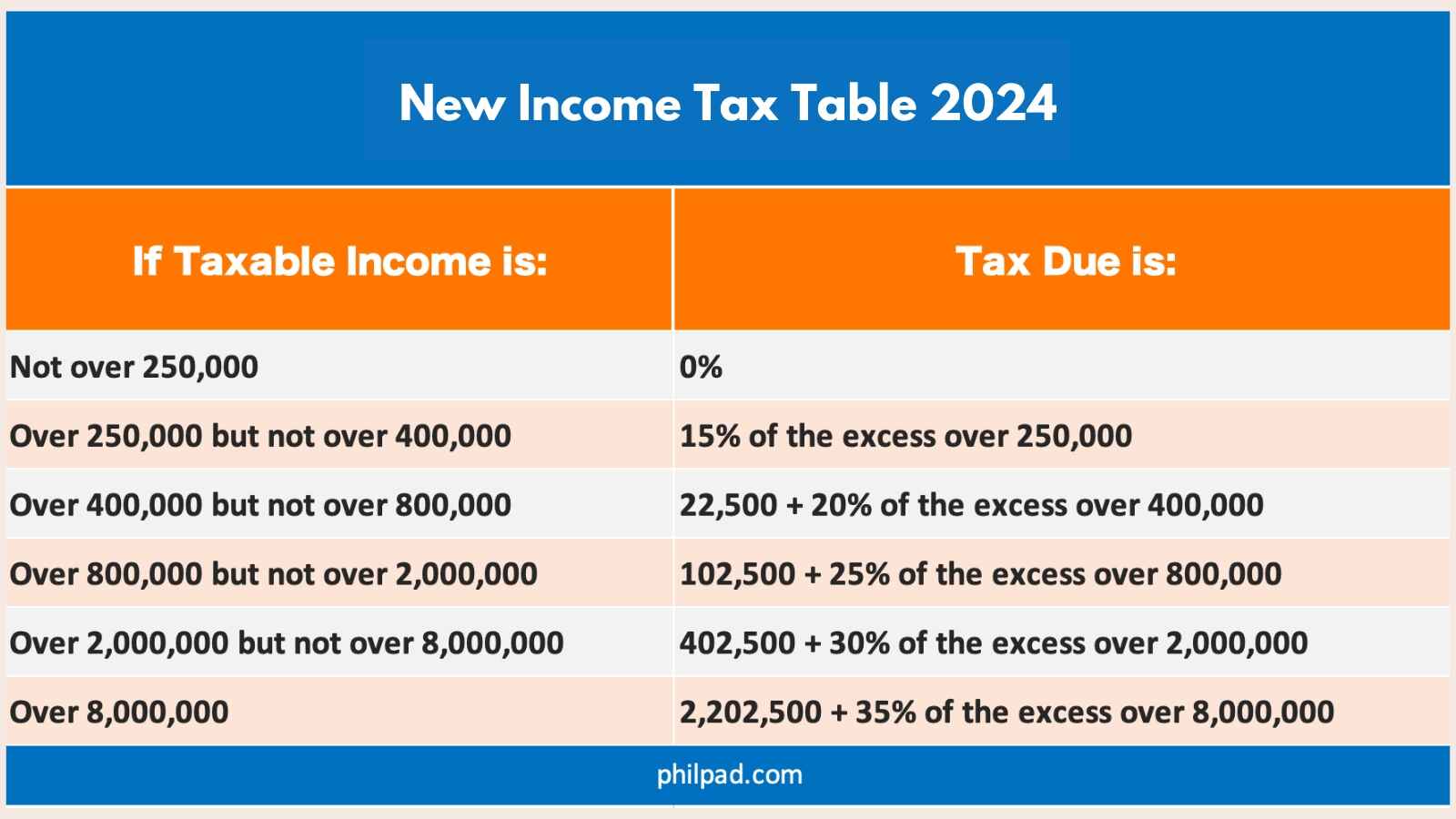

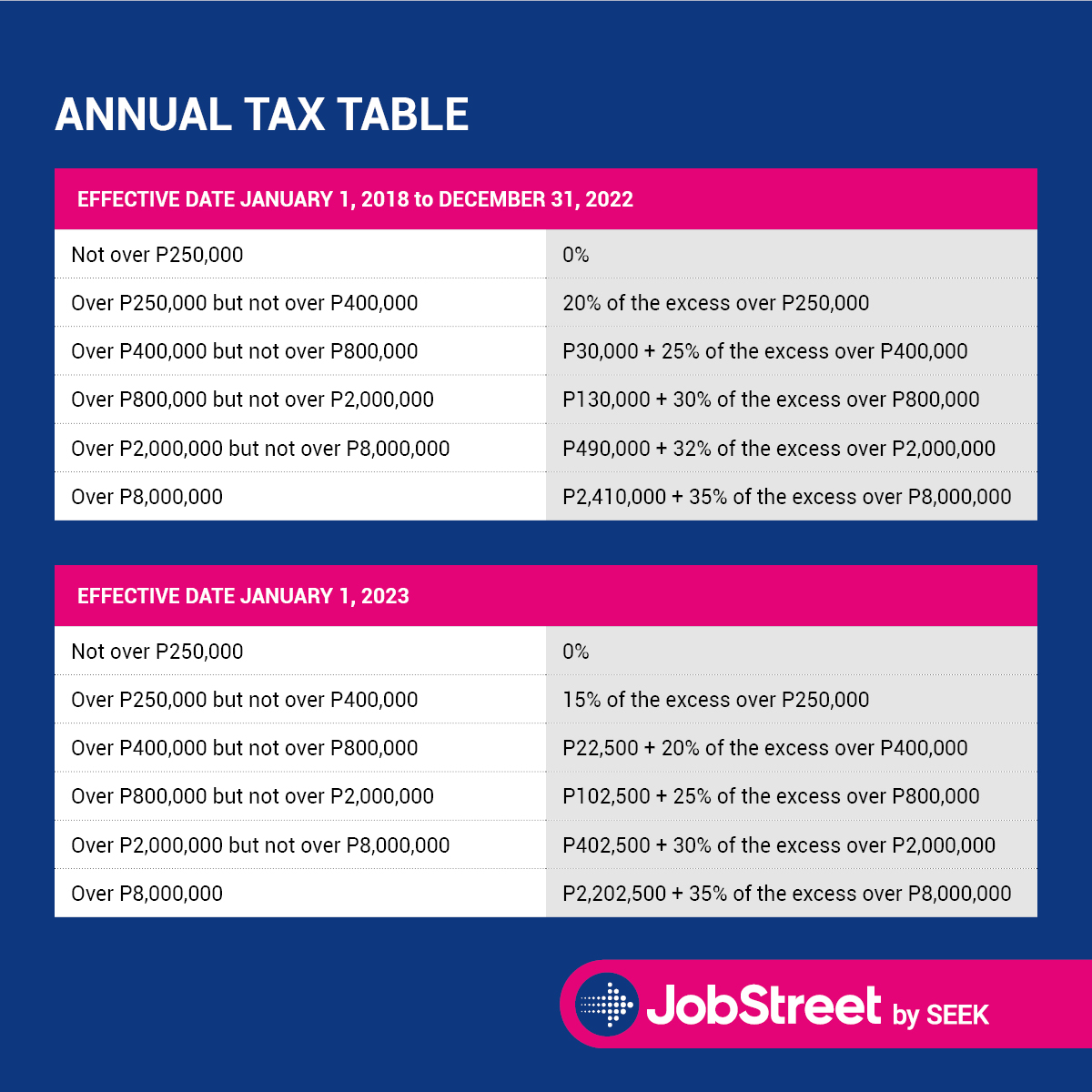

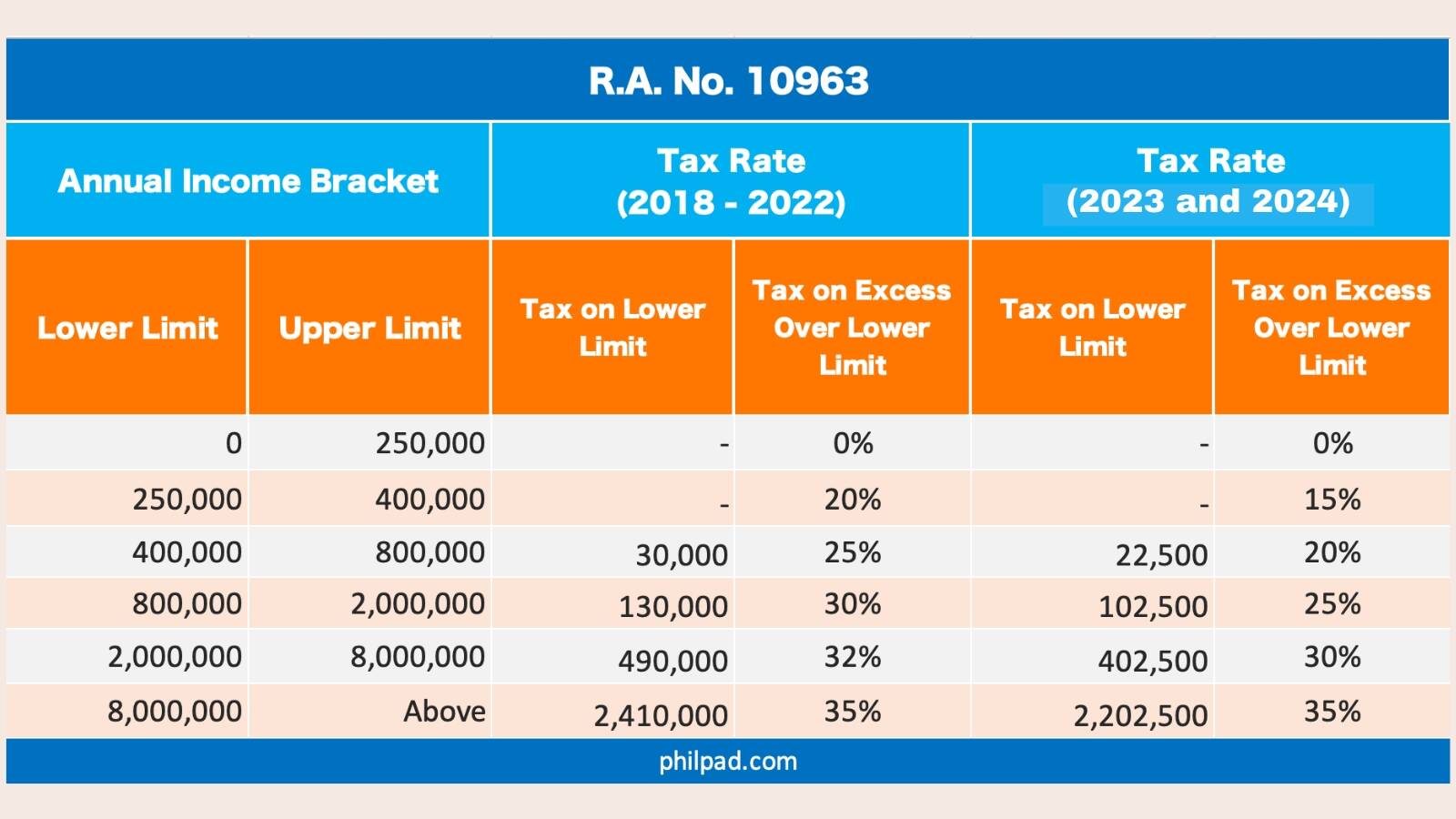

Tax Table 2025 Philippines Bir. New and update 2023 bir tax table from train law. The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due.

Tax rates for income subject to final tax. Amount of net taxable income (php) tax rate ₱250,000 and below:

Tax Table 2025 Philippines Bir Images References :

Source: carlgraham.pages.dev

Source: carlgraham.pages.dev

Philippine Tax Calculator 2025 Carl Graham, The republic of the philippines bureau of internal revenue (bir philippines) income tax calculation is easy to do once you understand how.

Source: www.efrennolasco.com

Source: www.efrennolasco.com

New BIR Tax Rates and Tax Table for 2018 in the Philippines, The philippines’ tax structure, including corporate income tax rates of 30% that can drop to 25% or 20% under certain conditions, plays a crucial role in attracting investments and.

Source: kylieallan.pages.dev

Source: kylieallan.pages.dev

Tax Bracket Philippines 2025 Kylie Allan, The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due.

Source: imagetou.com

Source: imagetou.com

Withholding Tax Table Philippines 2025 Image to u, It outlines how much tax individuals and.

Source: higolar54clibguide.z13.web.core.windows.net

Source: higolar54clibguide.z13.web.core.windows.net

Bi Pipe Schedule 40 Price Philippines 2025, Here’s the 2025 bir tax table to help you compute how much tax you’ll pay:

Source: brokeasshome.com

Source: brokeasshome.com

Annual Withholding Tax On Compensation Table Philippines, The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the philippine tax laws and their implementing.

Source: www.jobstreet.com.ph

Source: www.jobstreet.com.ph

The 2022 Bir Tax Table Jobstreet Philippines, It uses the 2025 bir income tax table for precise results, making sure you follow the latest tax laws.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

8 Photos Bir Withholding Tax Table 2017 Philippines And View Alqu Blog, Refer to the bir income tax table:

Source: www.carfare.me

Source: www.carfare.me

2019 Tax Philippines Table carfare.me 20192020, This article shows the new tax table with downloadable excel versions.

Source: alleneqolivette.pages.dev

Source: alleneqolivette.pages.dev

Bir Tax Calculator 2025 Philippines Randi Carolynn, The philippines’ tax structure, including corporate income tax rates of 30% that can drop to 25% or 20% under certain conditions, plays a crucial role in attracting investments and.

Category: 2025