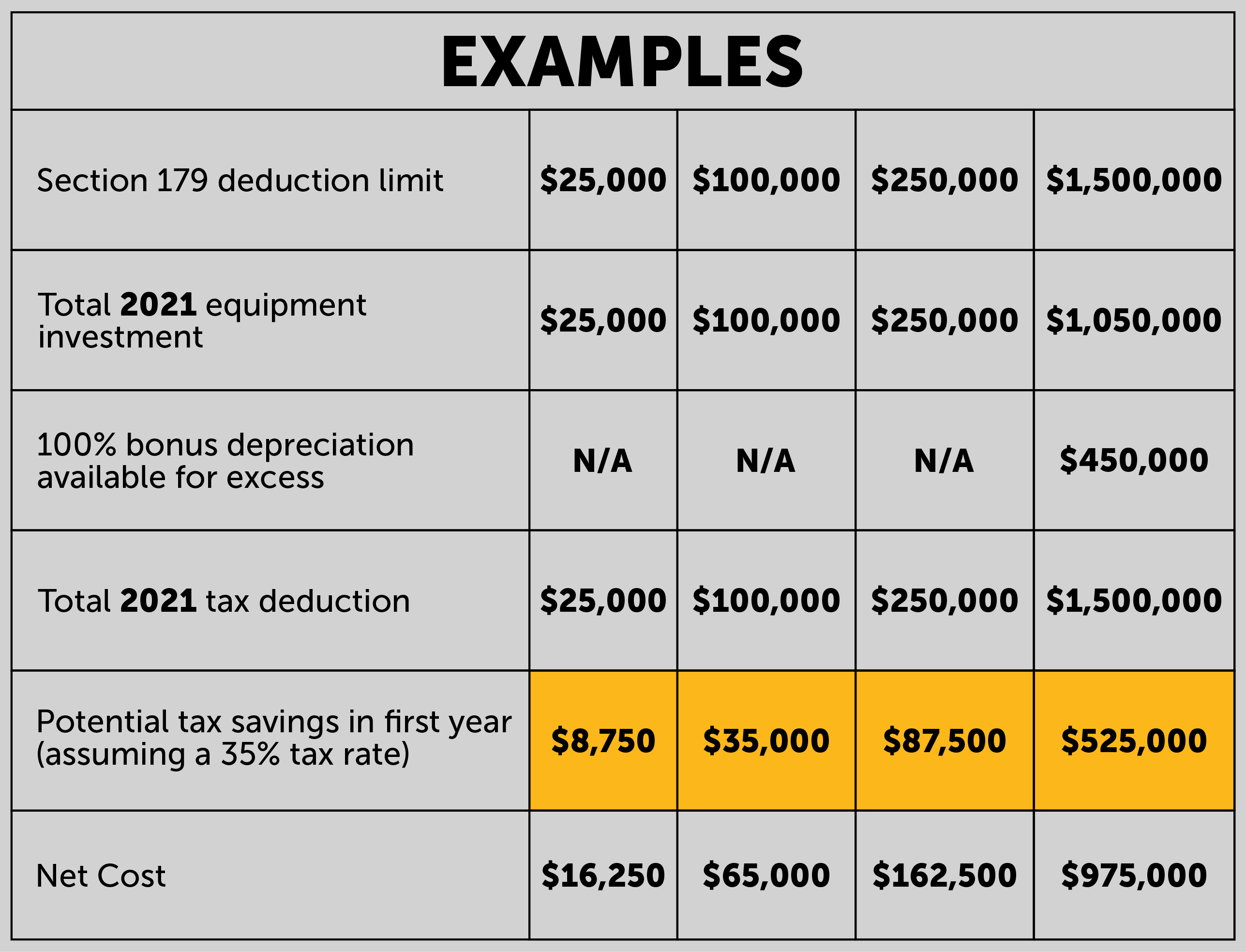

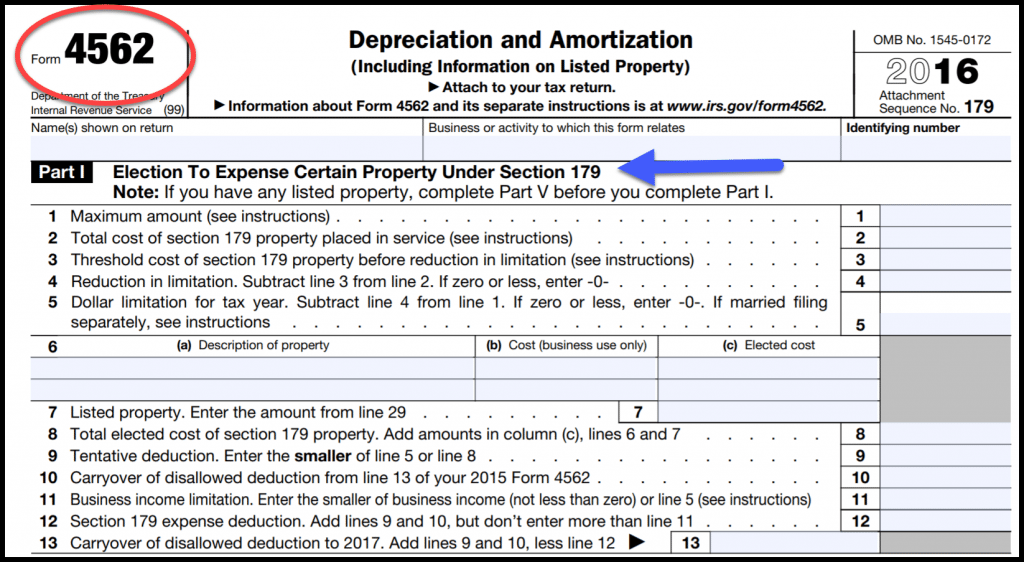

Irs Section 179 Deduction 2024 Vehicles. For tax year 2024, the maximum. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

The 2024 section 179 deduction limit for suvs is $30,500. These figures are subject to annual inflation.

Irs Section 179 Deduction 2024 Vehicles Images References :

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

Section 179 Deduction Vehicle List 2024 Irs Lory Silvia, Tax deduction allowing businesses to deduct full purchase cost of qualifying vehicles bought or leased during.

Source: annamariewtova.pages.dev

Source: annamariewtova.pages.dev

Section 179 Deduction Vehicle List 2024 Melli Siouxie, Learn about the 2024 irs depreciation limits for business vehicles, including luxury cars, suvs, trucks, and vans.

Source: madgeqlisbeth.pages.dev

Source: madgeqlisbeth.pages.dev

Sec 179 Limit 2024 Lura Mellie, It must be used for business.

Source: tiffiqshauna.pages.dev

Source: tiffiqshauna.pages.dev

Section 179 Deduction Vehicle List 2024 Excel nedi vivienne, Find out the depreciation limits for each year and important tax benefits.

Source: www.ridetoday.com

Source: www.ridetoday.com

Section 179 Tax Credit For Businesses and Fleet Tax Deductions, • heavy suvs*, pickups, and vans (over 6,000 lbs.

Source: www.section179.org

Source: www.section179.org

Section 179 Tax Deduction for 2024, Find out the depreciation limits for each year and important tax benefits.

Source: donicaqterrie.pages.dev

Source: donicaqterrie.pages.dev

2024 Section 179 Limits Ardys Winnah, Learn about the 2024 irs depreciation limits for business vehicles, including luxury cars, suvs, trucks, and vans.

![[Update] Section 179 Deduction Vehicle List 2024 XOA TAX [Update] Section 179 Deduction Vehicle List 2024 XOA TAX](https://www.xoatax.com/wp-content/uploads/Section-179.webp) Source: www.xoatax.com

Source: www.xoatax.com

[Update] Section 179 Deduction Vehicle List 2024 XOA TAX, Tax deduction allowing businesses to deduct full purchase cost of qualifying vehicles bought or leased during.

Source: www.netsapiens.com

Source: www.netsapiens.com

Section 179 IRS Tax Deduction Updated for 2024, Eligible vehicles include heavy suvs, work vehicles,.

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg) Source: www.gbu-presnenskij.ru

Source: www.gbu-presnenskij.ru

Section 179 IRS Tax Deduction Updated For 2023, 50 OFF, For 2024, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2023).

Posted in 2024